By Kaity Cornellier - 12/05/2022

By Kaity Cornellier - 12/05/2022

Table of Contents

- 1. What is a confirmation statement?

- 2. Who must file confirmation statements?

- 3. When should I file my confirmation statement?

- 4. What do I need before I file?

- 5. What company information do I need?

- 6. How do I file?

- 7. What if my confirmation statement is overdue?

- 8. Should dormant companies file confirmation statements?

- The best way to file confirmation statements

Once your limited company is up and running, you’ll need to stay on top of all your filing requirements: self assessments, annual accounts, VAT returns (if you’re registered), and of course, your annual confirmation statement.

But what is a confirmation statement, and why do you need to file one? If you’ve wondered this, you’re not alone, so read on to find out everything you need to know before you file your first confirmation statement.

1. What is a confirmation statement?

Confirmation Statement (n.)

An annual filing submitted by a limited company director that confirms the information Companies House holds about their company is correct and up-to-date.

The confirmation statement replaced the ‘annual return’ in 2016, which served a similar purpose.

You file confirmation statements to inform Companies House about certain changes to your company, like your Standard Industrial Classification (SIC) code, shareholder names, and more. You must file one even if nothing has changed, as this will tell Companies House that you’ve reviewed your information and confirmed it is correct.

Looking for a fully automated filing process to make your life easier? File confirmation statements with OnlineFilings™. We are authorised by Companies House to file confirmation statements on your behalf - all you need to do is check the information is correct. We’ll do the rest FILE YOUR CONFIRMATION STATEMENT

2. Who must file confirmation statements?

All limited companies must submit a confirmation statement every 12 months, whether they are dormant or active. Dormant or non-trading companies may have a different internal structure from those that are trading, so if you’ve stopped trading recently, make sure the information on Companies House register is up-to-date.

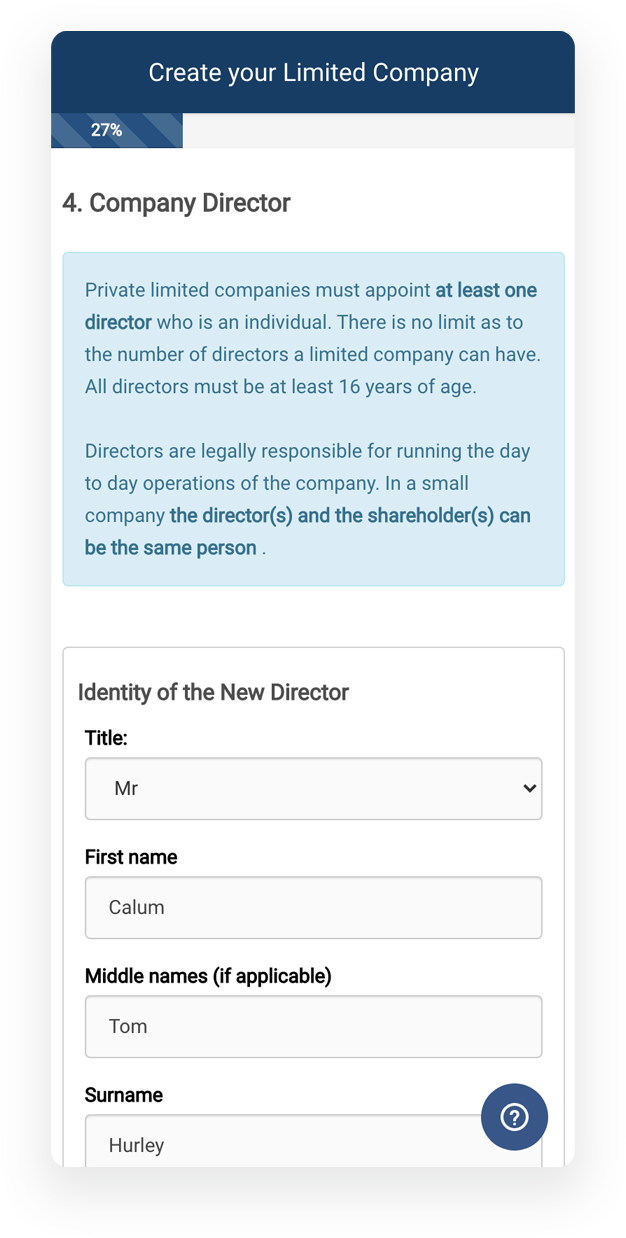

Directors, in particular, are responsible for filing statutory documents, including confirmation statements, with Companies House by their respective deadlines. This is the case even if administrative tasks like filing have been delegated to the company secretary.

3. When should I file my confirmation statement?

Limited companies must file confirmation statements every year, no later than 14 days after the end of your 12-month ‘review period’. This starts on the date of your company formation or ‘statement date’ of the previous confirmation statement. It ends the day before your formation anniversary or previous statement date.

Example

Susan formed a company on 26 April 2022.

Her 12-month review period would start on 26 April 2022 and end on 25 April 2023.

The statement date for her confirmation statement is 25 April 2023, and the filing deadline is 14 days later on 9 May 2022.

4. What do I need before I file?

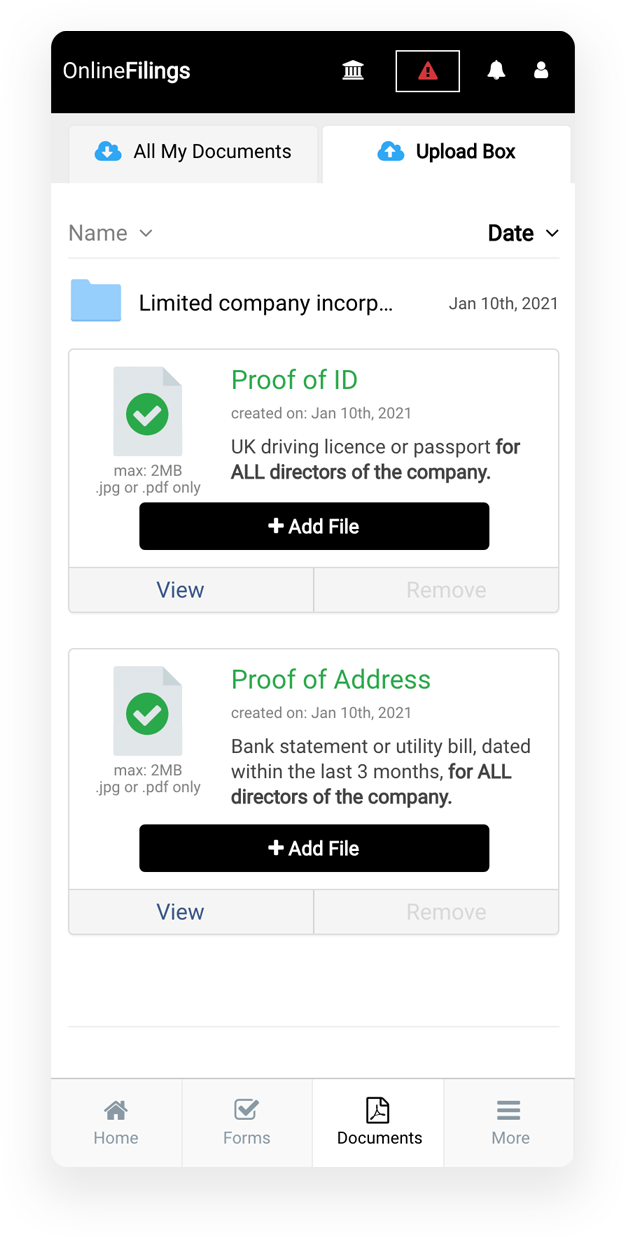

You’ll need your authentication code to submit your confirmation statement. This is the 6-digit code issued by Companies House to each company and it is used to authorise information filed online, essentially operating as a company offer’s signature. You’ll have received it when you incorporated your company.

If you don’t have an authentication code, OnlineFilings™ can request one on your behalf. We are authorised by Companies House to file confirmation statements, so we can apply for your authentication code as part of our simplified filing service. Click below to get started.FILE NOW

5. What company information do I need?

When you’re ready to file, you’ll need to review all your company’s information. This includes:

- Your registered office address and/or Single Alternative Inspection Location (SAIL) address

- Current company officers (directors, company secretary, partners, etc.)

- Shareholder names & the shares held by each (including class, quantity and details of any transfers)

- People with Significant Control (PSCs) or an exemption from keeping a PSC register

- Standard Industrial Classification (SIC) codes, essentially if the company’s principal business activities have changed

- Statement of capital, which outlines the details of all company shares (total number, aggregate nominal value, total per class, etc.)

You can only report certain changes to your company data on a confirmation statement, like your SIC codes, shareholder details, statement of capital, the trading status of shares, and an exemption from keeping a PSC register.

To change other information, like officers' details or registered office address, you’ll need to use specific Companies House forms. Alternatively, add these to your OnlineFilings confirmation statement order to save time and hassle.

6. How do I file?

You can choose to either file online or by post using the CS01 confirmation statement form, but online is advised as it’s the most convenient, secure option. You can file directly with Companies House WebFiling by logging in and manually entering all the necessary information about your company.

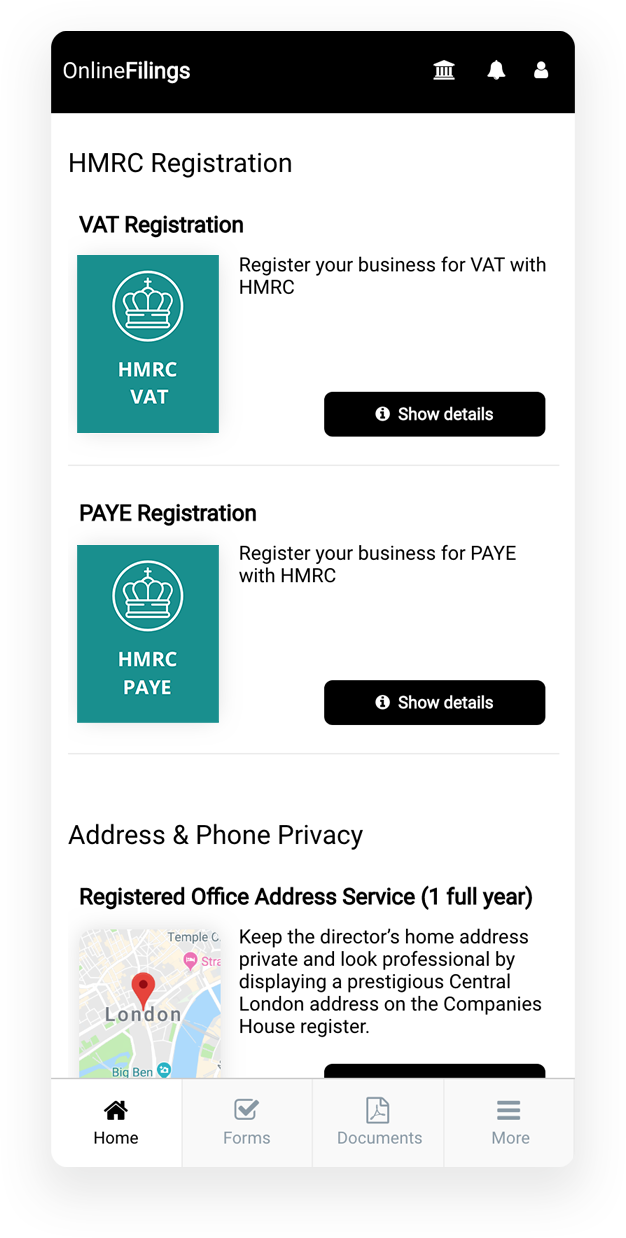

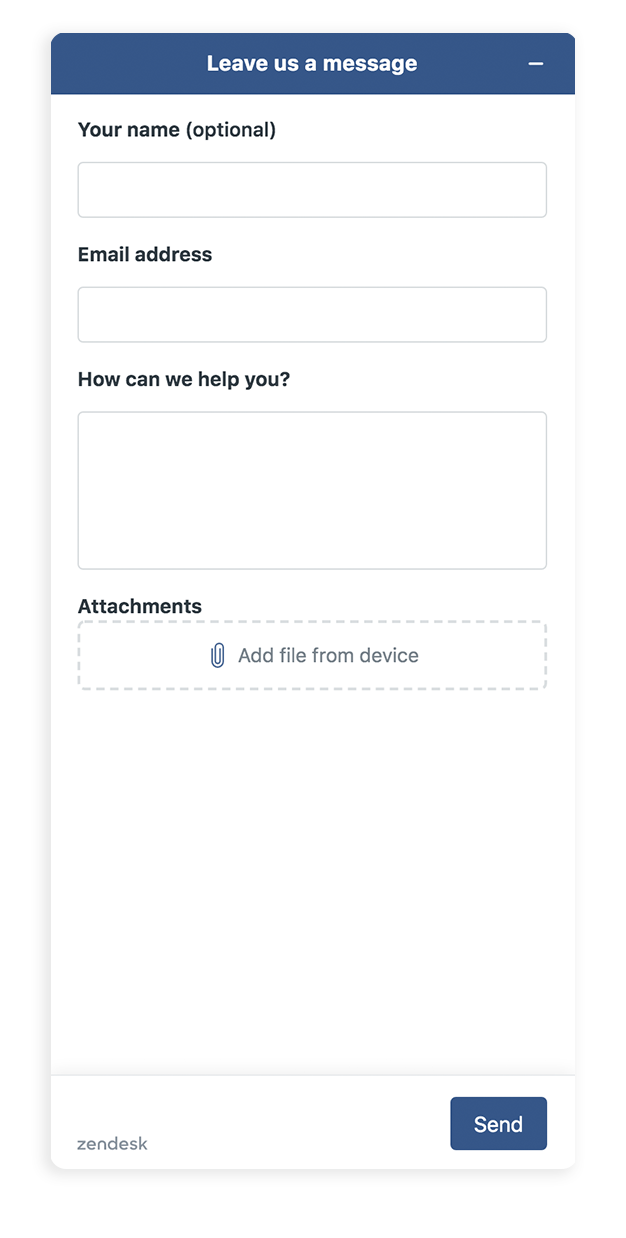

Alternatively, choose OnlineFilings™ and benefit from a pre-populated and simplified confirmation statement form, making it easy to update information and file efficiently. You can do this straight from your phone and you’ll even get access to our exclusive partners' offers to grow your business. Use the button below to get started.FILE NOW

7. What if my confirmation statement is overdue?

Confirmation statements are one of the quicker filing requirements you’ll have as a director, especially if you use OnlineFilings™, so it’s unlikely that you’ll forget. If you do, file it as soon as possible.

You won’t accrue a financial penalty if your confirmation statement’s overdue, but failing to file at all is considered a criminal offence. Your company could be struck off the register and dissolved by Companies House as they’ll assume you’re no longer trading.

Serious consequences are rare, but it is important that you file on time so Companies House register remains accurate and up-to-date. To help with this, OnlineFilings™ will send you annual reminders around the time of your company’s incorporation date, helping you file confirmation statements on time.

8. Should dormant companies file confirmation statements?

Yes, even if your company is dormant you are still required to file a confirmation statement every year.

However, if you are planning on dissolving your company, you can simply file for dissolution without filing a confirmation statement. You can also dissolve your company through OnlineFilings should you no longer intend to trade as a limited company.

The best way to file confirmation statements

In conclusion, all limited companies must file confirmation statements annually to confirm their information on Companies House register is correct.

As a director, you can file your confirmation statements quickly and easily using OnlineFilings™. We are authorised by Companies House to file confirmation statements on your behalf. Benefit from our fully managed same-day processing and personalised support throughout your business journey.

Ready to get started?

By Kaity Cornellier - 12/05/2022

By Kaity Cornellier - 12/05/2022