By Dimitri - 26/01/2021

By Dimitri - 26/01/2021

Table of Contents

- What is a UTR Number?

- Who Gets a UTR Number?

- Where You Can Find Your UTR Number

- Partnerships

- Limited Companies

- Limited Companies

- Sole Traders, Individual Taxpayers, and Partnerships

- How to Get a UTR Number

- Online

- Calling

- By Post

- The Information You Need

- Getting Assistance with the Process

- UTR Registration

- Sole Trader Registration

- Self Assessment Filing Services

- Need More Information?

Did you know that, according to the House of Commons Library, the UK government raises over £800 billion yearly in receipts that come from income from taxes as well as other sources, with income tax making up £195 billion of this amount?

Now that tax season is here, you may have questions about your UTR number. You may be asking yourself:

- “What is a UTR number?”

- “How do I get a UTR number?”

- “Do I need my UTR number to submit my tax return?”

If you don’t have the answers to these questions, you may feel stressed. After all, the deadline for submitting your Self Assessment tax return online for the 2019-2020 tax year now less than a week away.

If you don’t have your UTR number and don’t know how to get it, then this will only add to your stress. You may find yourself scrambling at the last minute so that you can file your tax return by 31 January 2021.

That’s why we’ve put together this article. Once you have all the information you need about UTR numbers, you can file your Self Assessment tax return correctly and on time. Read on to learn more.Register For Your UTR Now

What is a UTR Number?

UTR stands for Unique Taxpayer Reference number. This number, which is issued by HMRC, is ten digits long. Sometimes, the letter ‘K’ appears at the end of this string of digits. It is given to companies and individual taxpayers who are required to complete a tax return.

Another way of referring to the UTR is the tax reference.

Once you’ve been given a UTR number, you can’t get a new one. This works in the same way as when the government assigns you your National Insurance number.

The idea behind the UTR number is that it’s a way for HMRC to identify you as a taxpayer. Keep in mind, however, that taxpayers who are employed by other companies do not have UTRs. In the next section, we’ll cover who receives a UTR number.

Who Gets a UTR Number?

If you’re a taxpayer who has their own business or works as a freelancer, then you have to register for Self Assessment. When you do this, you are issued a UTR number by HMRC. (We’ll go more into this process in a moment.)

Other reasons for registering for Self Assessment are if you earn over £100,000 or if you owe tax on capital gains, dividends, or savings.

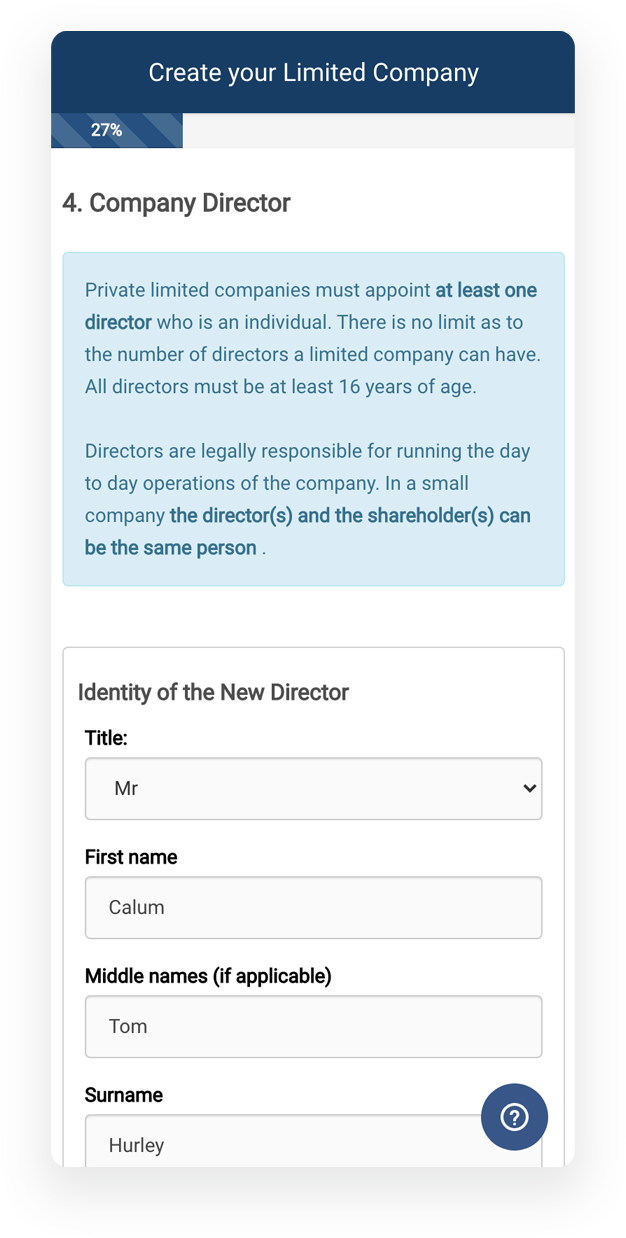

Additionally, limited companies are provided with UTR number once they have registered with the Companies House. So, if you run a limited company, you will also receive a UTR number for your company.

Where You Can Find Your UTR Number

If you are an individual taxpayer or a sole trader, then you can find your UTR number in your HMRC business tax account or personal tax account. Additionally, you can find your UTR number documented in any letters you receive from HMRC.

For example, if you received a letter recently reminding you of the upcoming deadline to submit your Self Assessment tax return by 31 January 2021, then you can find your UTR there.

Partnerships

If you run a business with a partner (or several), then each of you will have your own UTR number. Whilst you will be submitting a tax return for your business together, you are each required to submit your own tax return separately.

For this reason, HMRC requires you to have separate HMRC numbers so that filing and payments are easier for them to keep track of.

You and your business part can find each of your UTR numbers in your personal tax accounts. Additionally, you can find these numbers in letters sent to you by HMRC. However, be careful not to confuse the partnership UTR with those belonging to the partners.

When filing your tax return, this is especially important.

Limited Companies

Within 14 days of having registered your limited company with Companies House, you should receive the UTR number for your company. You can find the UTR number in that letter. Additionally, you can find your limited company’s UTR number in other letters, including payment reminders.

It will also appear in your business tax account.

If You’ve Lost Your UTR Number

If you think you’ve lost your UTR number, there is no need to panic. First, search thoroughly for it using the accounts and letters we reviewed in the last section. If you still can’t find it, there are some strategies you should follow depending on what type of UTR number you have been assigned by HMRC.

Sole Traders, Individual Taxpayers, and Partnerships

If you’re a sole trader or individual taxpayer who needs to file a Self Assessment tax return, you can contact HMRC on the phone to retrieve your lost UTR number. When you call in, ensure you have your National Insurance number with you, as this will be used to confirm your identity.

If you have a partnership company, the process is the same.

Limited Companies

If you have lost your limited company’s UTR number, the process of retrieving it is a little different. To retrieve it, you need to get in touch with HMRC and request a copy. To do this, you need to have your registered company name and company registration number on hand.

Once it has been verified that the limited company belongs to you, the UTR number will be sent to your limited company’s business address—the one that is on file with Companies House.

How to Get a UTR Number

There are different ways you can get a UTR number. You can do this by doing your UTR number registration online, calling HMRC, or sending them a letter. We’ll now review these processes so that you can decide which one is best for you or your company.

Online

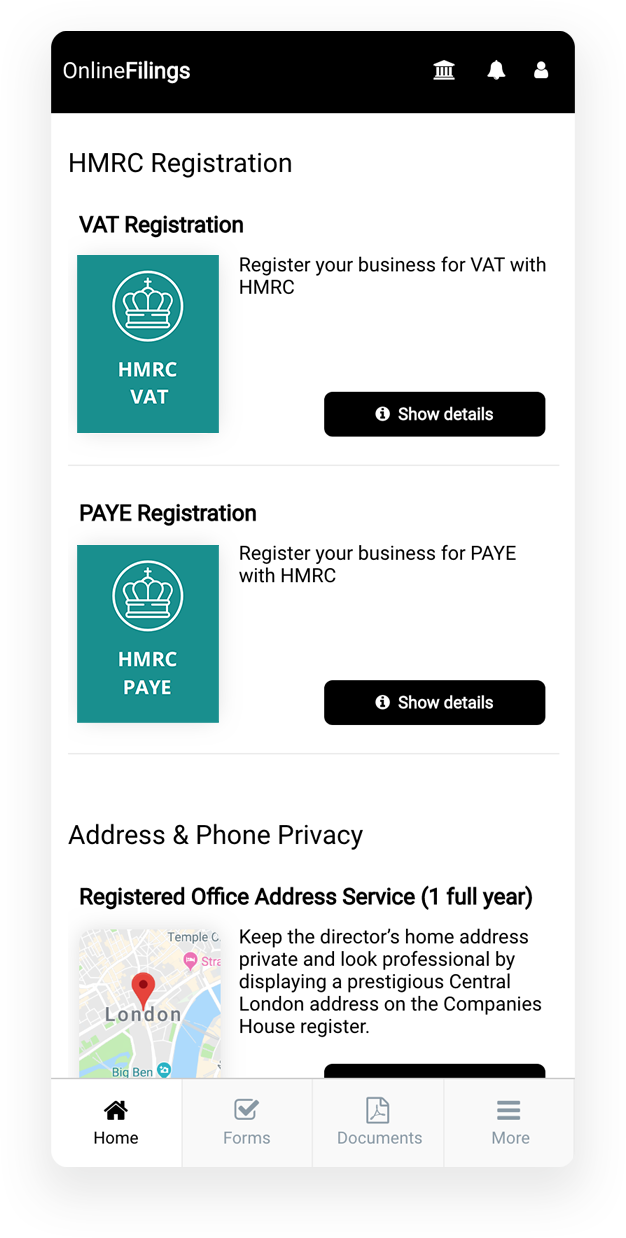

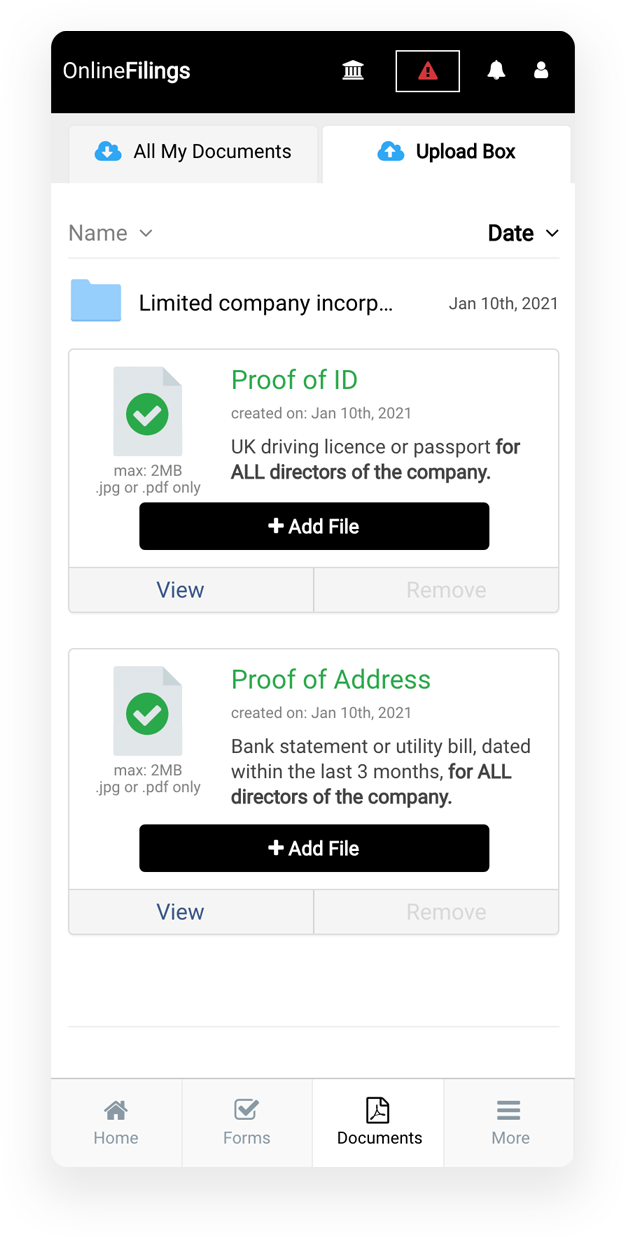

The easiest way to receive a UTR number is by getting it online. To do this, you first need to register for Self Assessment, set up your limited company, or complete your sole trader registration. Once this has been done, you will be automatically sent your UTR number.

To ensure that everything is done in a timely manner, you should register with HMRC about your Self Assessment return or your limited company the second that you start working for yourself or running your limited company.

Even though it is best to do it as soon as possible, it is recommended by HMRC to do this within the first three months of working for yourself or starting your business.

Once you have registered, you will receive an activation code. Usually, you will have to wait at least ten days for this code to arrive. Then, you have 28 days to register your tax account online with the code you have received.

After the process is complete, HMRC will send you your UTR number. If you don't receive it, you can call HMRC to see if there have been any issues on their end.

Calling

You can also call HMRC to get your UTR number. To do this, call them at 0300 200 3310. Once you have a representative on the line, tell them you want to receive your UTR number. They will ask you several questions, including details about yourself and about your business.

Keep in mind that, if you call, you may be encouraged to register for UTR number online. For this reason, it may be easier to simply complete the process online.

By Post

You can also apply for UTR number by post. However, because so much information is needed, there will be a lot of back and forth between you and HMRC. If you’re in a hurry, then we recommend registering as a sole trader online so that you receive your UTR number more quickly.

Considering that the deadline for filing your tax return is less than a week away, registering online really is the best choice. However, if you are registering so that you can file in time for next year, then you can still apply by post if that is your preference.

The Information You Need

When applying for a UTR number, you will have to include different information. This includes personal details such as your name, address, and date of birth. You will also have to provide your National Insurance number. These details will make it possible for HMRC to identify you when preparing your UTR number.

Additionally, you will be asked to provide your telephone number and email address so that they can get in touch with you if needed—and, of course, send you your UTR.

If you are registering your business or registering as a Sole Trader, then you will have to provide additional information regarding your business.

You will have to provide the date you began self-employment, information about what type of business you are running, and your business’s phone number and address.

If any additional information is needed, HMRC will let you know.

Getting Assistance with the Process

If it’s your first time getting a UTR number, you may need assistance with the process. After all, though this process can be done quickly online, you may not be sure about what information to provide about yourself or about your new business when registering as a Sole Trader, for a Self Assessment tax return, or as a limited company owner. For this reason, we have services available so that you can get assistance with the process.

UTR Registration

If you need help generally with your UTR registration, then we have a service that helps you complete your UTR Registration. This simplifies the entire process so that you are not staring blankly at the HMRC page wondering how to get started.

Sole Trader Registration

If you are registering as a Sole Trader for the first time, you may not be sure how to get started. Instead of having to stress about every detail, you can use our Sole Trader Registration service to simplify the process.

Self Assessment Filing Services

We also offer Self Assessment filing services. In addition to making it easier for you to receive your UTR number, this will ensure that you save money. If you file your Self Assessment tax return incorrectly, you may overlook tax relief options.

For example, if you have claimable expenses such as what you pay for a coworking space or what you paid for a piece of work-related technology, you can get some of this money back.

Additionally, if you don’t file your Self Assessment tax return correctly, you may end up having to pay hefty fines. The same will occur if you miscalculate the amount of money you have to pay for the 2019-2020 tax year.

For this reason, we recommend using our Self Assessment filing services to both receive your UTR and file correctly.

Need More Information?

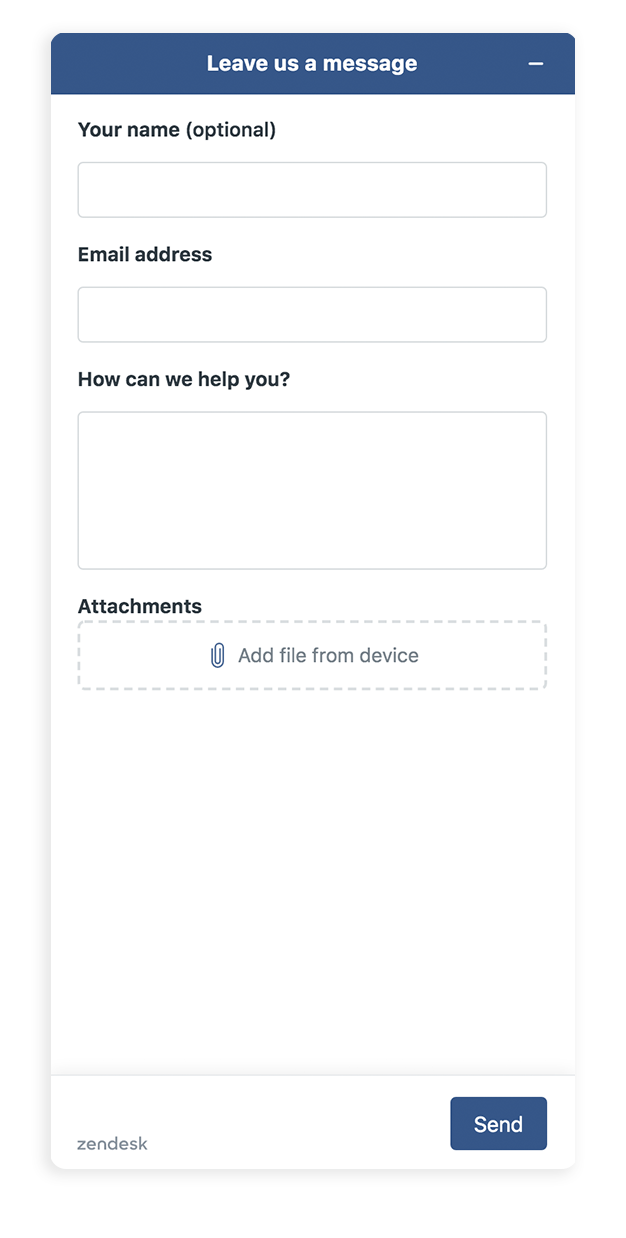

Now that you’ve learned about what a UTR number is, where to find it, and how to get it if you still need one, you may need more information. Perhaps you want to learn more about our tax filing services or you want to learn about how you can get money back when filing your return.

Whatever information you need, we’re here to help. At OnlineFilings, we’re experts when it comes to filing your tax return. We also offer assistance in starting your company and following compliance rules. To learn more about how we can help you, contact us here.

By Dimitri - 26/01/2021

By Dimitri - 26/01/2021