By Kaity Cornellier - 20/05/2022

By Kaity Cornellier - 20/05/2022

Table of Contents

- What is a dormant company?

- How to make a company dormant

- Do dormant companies have any filing responsibilities?

- How long can I keep my company dormant?

- What will I need to do if I start trading again?

- Make a company dormant with OnlineFilings

If your company is no longer trading, you could consider going dormant. As a dormant limited company, you’ll have limited filing responsibilities and won’t need to pay Corporation Tax.

Looking to go dormant and wondering what it entails? Read on to discover how to register companies as dormant with Companies House and HMRC.

What is a dormant company?

A dormant limited company is no longer trading and doesn’t have any other income. 'Trading' includes buying, selling, renting property, advertising, employing someone, gaining interest, and income from investments. There are different dormancy conditions for HMRC and Companies House.

Companies House considers your company dormant if you haven’t had any significant accounting transactions during the current financial year, which means your Standard Industrial Code (SIC) is 99999. HMRC considers your company dormant for Corporation Tax if it’s new and hasn’t begun trading. This would mean you wouldn’t pay any Corporation Tax.

Dormant limited companies can still make some specific transactions, including payments for shares, fees to change the company’s name, penalties, and filing fees, as these transactions would not be entered into a company’s accounting records. Any other type of transaction will make your company ‘active’ again.

How to make a company dormant

Notifying Companies House

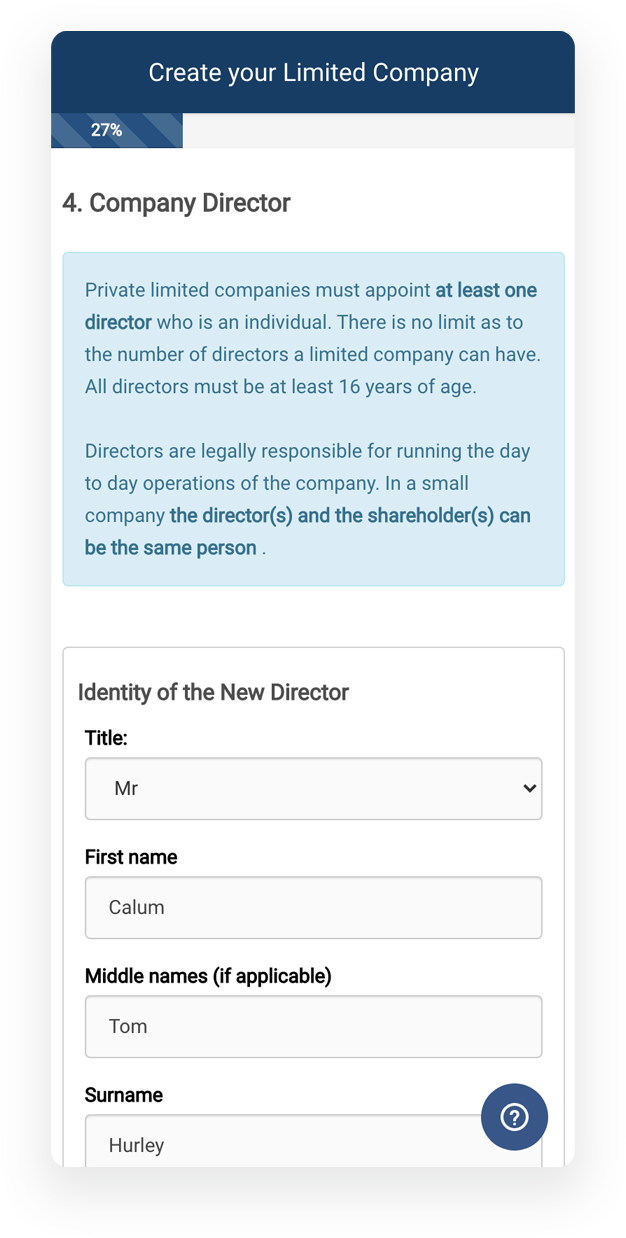

In order to make a company dormant with Companies House, you’ll need to send an application to Companies House. They will then change your SIC code to 99999, indicating that your company is dormant and unable to trade. You can streamline this process with OnlineFilings.

We’ll file all documents on your behalf and even handle your annual statutory filings if you choose our Compliance package. Pricing starts at just £49, all-inclusive.MAKE MY COMPANY DORMANT

Notifying HMRC

Once Companies House has been notified, you’ll need to let HMRC know that the company is dormant for Corporation Tax. If you do not, HMRC will still expect you to pay Corporation Tax and submit Corporation tax returns.

Before you start, make sure you have a few things on hand:

- Your unique taxpayer reference number (UTR)

- Your company’s name

- The date you ceased trading

As a dormant company, you will still need to file dormant accounts every financial year. Once you’ve notified HMRC, you have a few more administrative tasks before officially going dormant.

Checklist: 5 steps to finish making a company dormant

To ensure your transition to dormant goes as smoothly as possible, make sure you’ve tied up any loose ends, including:

- Paying any unpaid invoices

- Preparing final accounts up to the financial year’s end

- Closing your PAYE scheme (if you’re registered) and winding up payroll

- Closing all business bank accounts (especially those with interest)

- Terminating your contracts with service providers, including telephone & broadband suppliers

- De-registering for VAT within 30 days of going dormant (if you’re registered)

Completing these tasks will mark the end of the process to make a company dormant.

Do dormant companies have any filing responsibilities?

Dormant companies have reduced filing responsibilities, but there are still a few documents you’ll need to submit each year:

- You will still need to file a confirmation statement

- You’ll also need to submit annual accounts that confirm your dormant status, either online or using this form

MAKE MY COMPANY DORMANTHowever, other responsibilities like your Corporate tax returns, VAT returns (if you’re registered), and other documents won’t need to be filed when you’re dormant. Generally speaking, here are the filing requirements that dormant limited companies have:

Type of filing | Active companies | Dormant companies |

Confirmation Statement | ✔ | ✔ |

Annual (Dormant) Accounts | ✔ | ✔ |

Corporate Tax Return | ✔ | ✖ |

VAT Returns (if registered) | ✔ | ✖ |

PAYE RTI reports (if registered) | ✔ | ✔ |

This isn’t the case for every limited company. For example, if you traded before going dormant, HMRC usually sends you a notice to submit a final Corporate Tax Return. This document includes the period of activity before your company became dormant and works out the amount of Corporation tax your business owes if any.

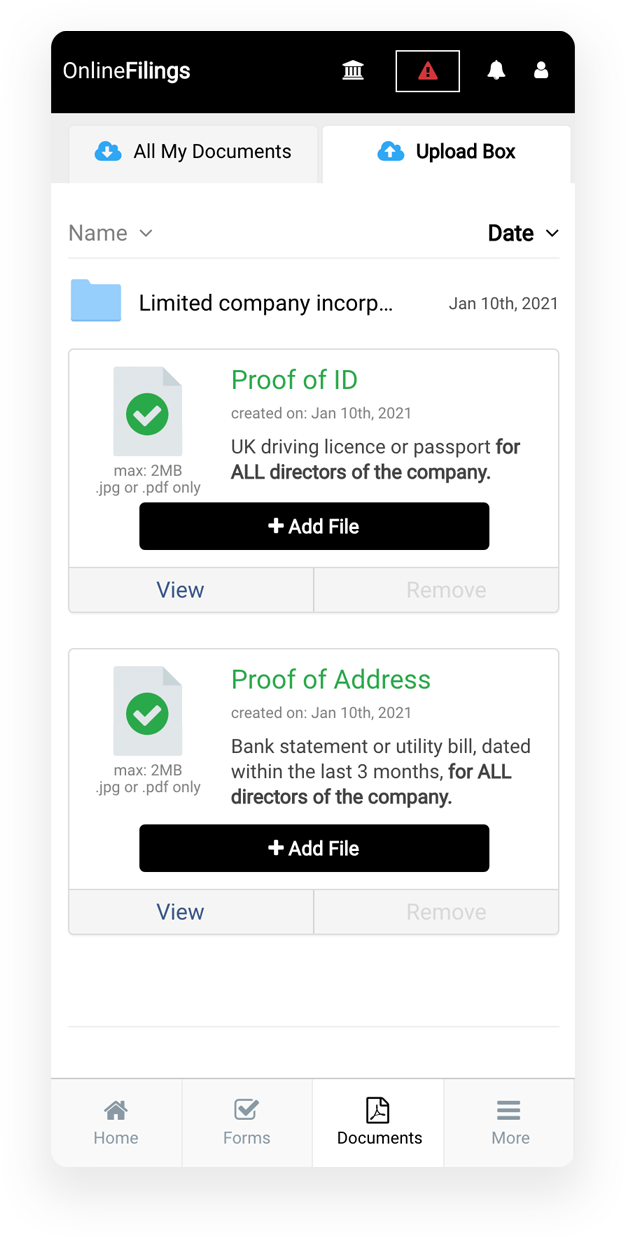

Additionally, you’ll need to maintain a registered office address after you register a company as dormant. This can be your home or a professional service address - just remember that the funds to pay for this service can’t come from your dormant limited company.

How long can I keep my company dormant?

There is no set time limit on keeping your company dormant. However, consider how long you plan to be dormant and determine if it’s short term or long term. If it’s likely to be long term, it might make more sense to dissolve your company and open a new one in the future.

What will I need to do if I start trading again?

If you start trading again or receive any form of income, notify HM Revenue and Customs (HMRC) within 3 months. To do this, you’ll need your business’s Government Gateway user ID. If you do not have a user ID, you can create one when you sign in.

Tell HMRC that your company has restarted trading by registering for Corporation Tax again. You can do this in your business tax account. After that, you have a few filing responsibilities to take care of. You’ll need to file your accounts and tax return with Companies House and HMRC by the deadlines:

Action | Deadline |

File first accounts with Companies House | 21 months after the date you registered with Companies House |

File annual accounts with Companies House | 9 months after your company’s financial year ends |

Pay Corporation Tax or tell HMRC that your limited company does not owe any | 9 months and 1 day after your ‘accounting period’ for Corporation Tax ends |

File a Company Tax Return | 12 months after your accounting period for Corporation Tax ends |

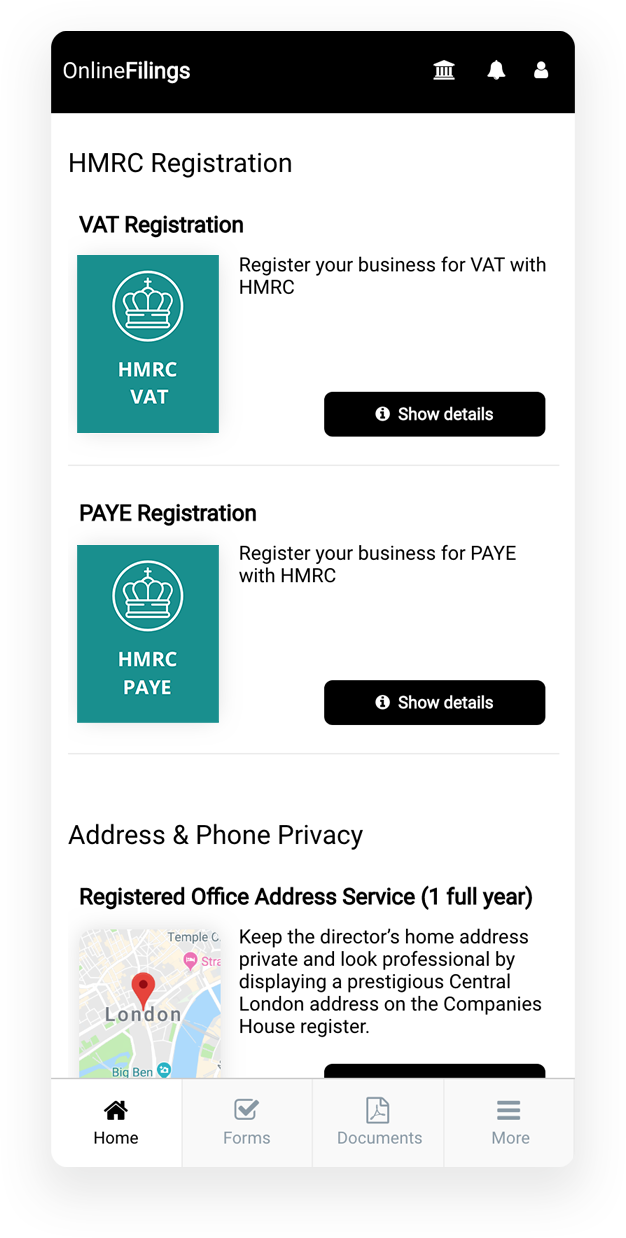

Make a company dormant with OnlineFilings

If you’re ready to make a company dormant but not looking forward to the paperwork, let us file for you.

Benefit from a simplified application form, personalised support throughout the process, and exclusive offers from our partners to benefit your business. Even automate your confirmation statement and other statutory filings with our Compliance package.

Ready to get started?

By Kaity Cornellier - 20/05/2022

By Kaity Cornellier - 20/05/2022